Lesson 1

Welcome to the Nanodegree Program

Welcome to the exciting world of Quantitative Trading! Say hello to your instructors and get an overview of the program.

Nanodegree Program

Complete real-world projects designed by industry experts, covering topics from asset management to trading signal generation. Master AI algorithms for trading, and build your career-ready portfolio.

Complete real-world projects designed by industry experts, covering topics from asset management to trading signal generation. Master AI algorithms for trading, and build your career-ready portfolio.

Advanced

5 months

Real-world Projects

Completion Certificate

Last Updated July 25, 2024

Skills you'll learn:

Prerequisites:

Course 1 • 2 months

Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management. Use Python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization.

Lesson 1

Welcome to the exciting world of Quantitative Trading! Say hello to your instructors and get an overview of the program.

Lesson 2

You are starting a challenging but rewarding journey! Take 5 minutes to read how to get help with projects and content.

Lesson 3

What to do if you have questions about your account or general questions about the program.

Lesson 4

Learn about stocks and common terminology used when analyzing stocks.

Lesson 5

Learn about how modern stock markets function, how trades are executed and prices are set. Study market behavior, and analyze price and volume data to identify potential trading signals.

Lesson 6

Learn how to adjust market data for corporate actions, include fundamental information in your analysis and compute technical indicators.

Lesson 7

Learn how to calculate stock returns, and log returns in particular. Learn why log returns are used to analyze financial data.

Lesson 8

Learn about alpha signals, and how they can be applied to a long/short trading strategy. Learn about momentum, a common alpha signal used in trading strategies.

Lesson 9 • Project

Learn to implement a trading strategy on your own and test to see if it has the potential to be profitable.

Lesson 10

Learn about the overall quant workflow, including alpha signal generation, alpha combination, portfolio optimization, and trading.

Lesson 11

Learn the importance of outliers and how to detect them. Learn about methods designed to handle outliers.

Lesson 12

Learn about regression, and related statistical tools that pre-process data before regression analysis. See how regression relates to trading and other more advanced methods.

Lesson 13

Learn about advanced methods for time series analysis, including ARMA, ARIMA, Kalman Filters, Particle Filters, and recurrent neural networks.

Lesson 14

Learn about stock volatility, and how the GARCH model analysis volatility. See how volatility is used in equity trading.

Lesson 15

Learn about pairs trading, and study the tools used in identifying stock pairs and making trading decisions.

Lesson 16 • Project

Implement the breakout strategy, find and remove outliers, and test to see if it can be a profitable strategy.

Lesson 17

Gain an overview of stocks, indices and funds. Also learn how to construct an index.

Lesson 18

Learn about Exchanged Traded Funds (ETFs) and how they are used by investors and fund managers.

Lesson 19

Learn the fundamentals of portfolio theory, which are key to designing portfolios for mutual funds, hedge funds and ETFs.

Lesson 20

Learn how to optimize portfolios to meet certain criteria and constraints. Get hands on experience in optimizing a portfolio with the cvxpy Python library.

Lesson 21 • Project

Build a smart beta portfolio against an index and optimize a portfolio using quadratic programming.

Lesson 22

In the next 7 lessons and project, learn about factor investing and alpha research. These lessons and the project were designed by Jonathan Larkin, equities trader and quant investor.

Lesson 23

Learn the theory of factor models, distinguish between alpha and risk factors, and get an overview of types of factors.

Lesson 24

Learn how to model portfolio risk using factors.

Lesson 25

Learn about two important types of risk models: time series and cross-sectional risk models.

Lesson 26

Learn about Principle Component Analysis and how it's used to build risk factor models.

Lesson 27

Learn about alpha generation and evaluation from a practitioner's perspective.

Lesson 28

Learn about alpha research from a practitioner's perspective.

Lesson 29

Learn about portfolio optimization using alpha factors and risk factor models.

Lesson 30 • Project

Research and implement alpha factors, build a risk factor model. Use alpha factors and risk factors to optimize a portfolio.

Course 2 • 3 months

Learn how to analyze alternative data and use machine learning to generate trading signals. Run a backtest to evaluate and combine top performing signals.

Lesson 1

Welcome to Term 2! Say hello to your instructors and get an overview of the program.

Lesson 2

Learn how to build a Natural Language Processing pipeline.

Lesson 3

Learn to prepare text obtained from different sources for further processing, by cleaning, normalizing and splitting it into individual words or tokens.

Lesson 4

Transform text using methods like Bag-of-Words, TF-IDF, Word2Vec and GloVE to extract features that you can use in machine learning models.

Lesson 5

Learn how to scrape data from financial documents using Regular Expressions and BeautifulSoup

Lesson 6

Learn how to apply to NLP to financial statements

Lesson 7 • Project

NLP Analysis on 10-k financial statements to generate an alpha factor.

Lesson 8

In this lesson, Luis will teach you the foundations of deep learning and neural networks. You'll also implement gradient descent and backpropagation in python, right here in the classroom!

Lesson 9

Now that you know what neural networks are, in this lesson you will learn several techniques to improve their training.

Lesson 10

Learn how to use PyTorch for building deep learning models

Lesson 11

Learn how to use recurrent neural networks to learn from sequential data such as text. Build a network that can generate realistic text one letter at a time.

Lesson 12

In this lesson, you'll learn about embeddings in neural networks by implementing the Word2Vec model.

Lesson 13

Implement a sentiment prediction RNN for predicting whether a movie review is positive or negative!

Lesson 14 • Project

Build a deep learning model to classify the sentiment of messages.

Lesson 15

Learn about machine learning from a bird's-eye-view.

Lesson 16

Decision trees are a structure for decision-making where each decision leads to a set of consequences or additional decisions.

Lesson 17

Learn about metrics to evaluate models and about how to avoid over- and underfitting.

Lesson 18

Learn about random forest models and how to use them to combine alpha factors.

Lesson 19

Learn to engineer features such as market dispersion, market volatility, sector and date parts. Also learn to engineer targets (labels) that are robust to market changes over time.

Lesson 20

Learn about an issue with non-independent labels that comes up during alpha combination with machine learning models.

Lesson 21

Feature importance helps us decide how relevant each feature is to a machine learning model's predictions. Learn about two methods for calculating feature importance.

Lesson 22 • Project

Build a random forest to generate better alpha.

Lesson 23

Backtesting helps you determine whether or not your strategies can be generalizable to future unseen data.

Lesson 24

Learn about how to make the portfolio optimization in a backtest more realistic, and also more computationally efficient.

Lesson 25

Use performance attribution to determine how each factor contributed to the portfolio's results.

Lesson 26 • Project

Build a backtester using Barra data.

(Optional) Course 3 • 8 hours

Lesson 1

Welcome to Introduction to Python! Here's an overview of the course.

Lesson 2

Familiarize yourself with the building blocks of Python! Learn about data types and operators, compound data structures, type conversion, built-in functions, and style guidelines.

Lesson 3

Build logic into your code with control flow tools! Learn about conditional statements, repeating code with loops and useful built-in functions, and list comprehensions.

Lesson 4

Learn how to use functions to improve and reuse your code! Learn about functions, variable scope, documentation, lambda expressions, iterators, and generators.

Lesson 5

Setup your own programming environment to write and run Python scripts locally! Learn good scripting practices, interact with different inputs, and discover awesome tools.

(Optional) Course 4 • 4 hours

Lesson 1

Take a sneak peek into the beautiful world of Linear Algebra and learn why it is such an important mathematical tool.

Lesson 2

Learn about vectors, the basic building block of Linear Algebra.

Lesson 3

Learn how to scale and add vectors and how to visualize the process.

Lesson 4

What is a linear transformation and how is it directly related to matrices? Learn how to apply the math and visualize the concept.

Content Developer

Mat is a former physicist, research neuroscientist, and data scientist. He did his PhD and Postdoctoral Fellowship at the University of California, Berkeley.

Instructor

Parnian is a self-taught AI programmer and researcher. Previously, she interned at OpenAI on multi-agent Reinforcement Learning and organized the first OpenAI hackathon. She also runs a ShannonLabs fellowship to support the next generation of independent researchers.

Instructor

Eddy has worked at BlackRock, Thomson Reuters, and Morgan Stanley, and has an MS in Financial Engineering from HEC Lausanne. Eddy taught data analytics at UC Berkeley and contributed to Udacity's Self-Driving Car program.

Instructor

Brok has a background of over five years of software engineering experience from companies like Optimal Blue. Brok has built Udacity projects for the Self Driving Car, Deep Learning, and AI Nanodegree programs.

Instructor

Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. She formerly taught data science at The Data Incubator.

Curriculum Lead

Cindy is a quantitative analyst with experience working for financial institutions such as Bank of America Merrill Lynch, Morgan Stanley, and Ping An Securities. She has an MS in Computational Finance from Carnegie Mellon University.

Curriculum Lead

Cezanne is an expert in computer vision with a Masters in Electrical Engineering from Stanford University. As a former researcher in genomics and biomedical imaging, she's applied computer vision and deep learning to medical diagnostic applications.

Instructor

Arpan is a computer scientist with a PhD from North Carolina State University. He teaches at Georgia Tech (within the Masters in Computer Science program), and is a coauthor of the book Practical Graph Mining with R.

Instructor

Luis was formerly a Machine Learning Engineer at Google. He holds a PhD in mathematics from the University of Michigan, and a Postdoctoral Fellowship at the University of Quebec at Montreal.

Content Developer

Juan is a computational physicist with a Masters in Astronomy. He is finishing his PhD in Biophysics. He previously worked at NASA developing space instruments and writing software to analyze large amounts of scientific data using machine learning techniques.

Average Rating: 4.6 Stars

496 Reviews

Anonymous

December 28, 2022

The solution is simpler than I thought. Wish I got more hint on which numpy functions to use

Luke V.

October 5, 2022

It is great so far. Interesting material and related project. Hopefully the remaining material is of the same standard

CEM H.

September 7, 2022

That is a great program to learn fundamentals and inner workings of algorithmic trading. I could see Finance becoming a multidiciplinary field in the near future. I wish there is a more advanced nanodegree to continue after finishing this one.

Aimar Cyusa M.

August 22, 2022

it's going great and it is showing me insight on the world of quant finance

Jose Jesus C.

June 25, 2022

it exceeded my expectations the context is very clear explained! but what I really love are the projects they are really challenging and enforce your understanding of the topics learned in the module

Combine technology training for employees with industry experts, mentors, and projects, for critical thinking that pushes innovation. Our proven upskilling system goes after success—relentlessly.

Demonstrate proficiency with practical projects

Projects are based on real-world scenarios and challenges, allowing you to apply the skills you learn to practical situations, while giving you real hands-on experience.

Gain proven experience

Retain knowledge longer

Apply new skills immediately

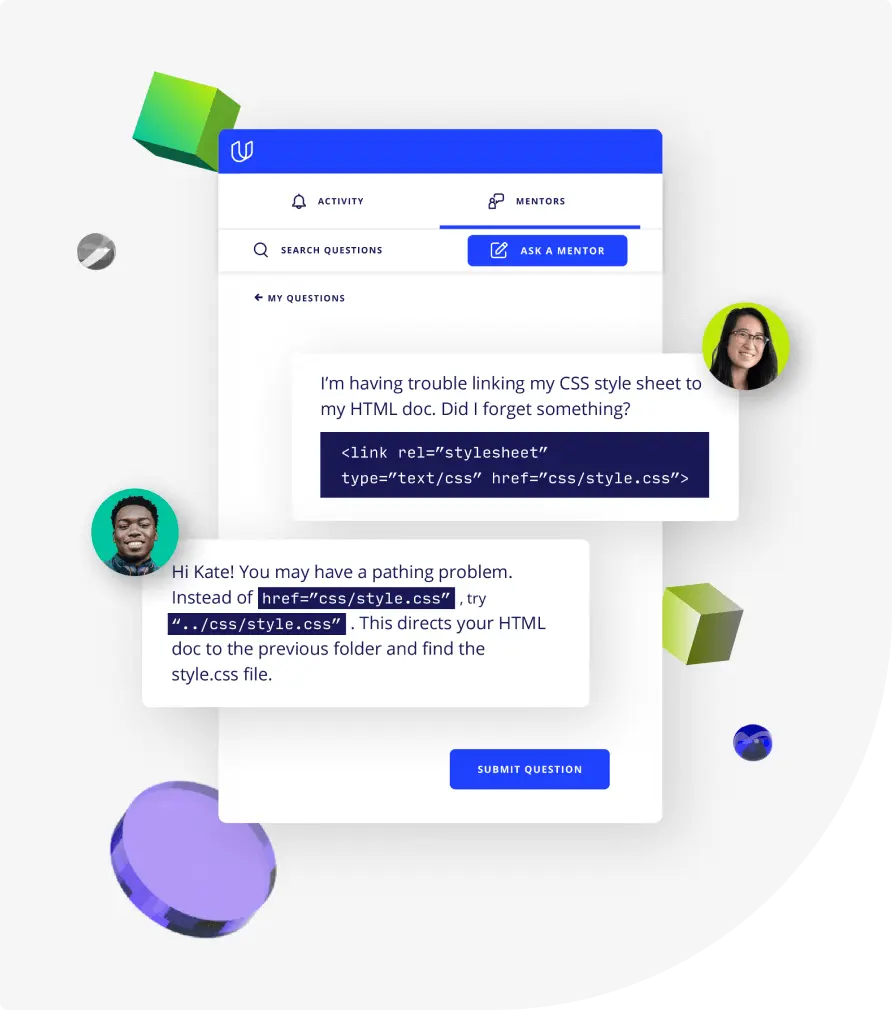

Top-tier services to ensure learner success

Reviewers provide timely and constructive feedback on your project submissions, highlighting areas of improvement and offering practical tips to enhance your work.

Get help from subject matter experts

Learn industry best practices

Gain valuable insights and improve your skills

Full Catalog Access

One subscription opens up this course and our entire catalog of projects and skills.

Average time to complete a Nanodegree program

(909)

4 months

, Intermediate

(256)

2 months

, Intermediate

(328)

2 months

, Advanced

(275)

2 months

, Advanced

(450)

3 months

, Advanced

(235)

3 months

, Intermediate

4 months

, Intermediate

(87)

4 months

, Advanced

(81)

2 months

, Intermediate

(93)

2 months

, Intermediate

(807)

2 months

, Beginner

(498)

3 months

, Intermediate

(126)

3 months

, Advanced

4 weeks

, Beginner

(363)

3 months

, Intermediate

4 weeks

, Beginner

AI for Trading

(909)

4 months

, Intermediate

(256)

2 months

, Intermediate

(328)

2 months

, Advanced

(275)

2 months

, Advanced

(450)

3 months

, Advanced

(235)

3 months

, Intermediate

4 months

, Intermediate

(87)

4 months

, Advanced

(81)

2 months

, Intermediate

(93)

2 months

, Intermediate

(807)

2 months

, Beginner

(498)

3 months

, Intermediate

(126)

3 months

, Advanced

4 weeks

, Beginner

(363)

3 months

, Intermediate

4 weeks

, Beginner