Mat Leonard

Content Developer

Mat is a former physicist, research neuroscientist, and data scientist. He did his PhD and Postdoctoral Fellowship at the University of California, Berkeley.

Nanodegree Program

Complete real-world projects designed by industry experts, covering topics from asset management to trading signal generation. Master AI algorithms for trading, and build your career-ready portfolio.

Complete real-world projects designed by industry experts, covering topics from asset management to trading signal generation. Master AI algorithms for trading, and build your career-ready portfolio.

Advanced

5 months

Real-world Projects

Completion Certificate

Last Updated April 21, 2024

Course 1 • 2 months

Learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management. Use Python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization.

Course 2 • 3 months

Learn how to analyze alternative data and use machine learning to generate trading signals. Run a backtest to evaluate and combine top performing signals.

(Optional) Course 3 • 8 hours

(Optional) Course 4 • 4 hours

Content Developer

Mat is a former physicist, research neuroscientist, and data scientist. He did his PhD and Postdoctoral Fellowship at the University of California, Berkeley.

Instructor

Parnian is a self-taught AI programmer and researcher. Previously, she interned at OpenAI on multi-agent Reinforcement Learning and organized the first OpenAI hackathon. She also runs a ShannonLabs fellowship to support the next generation of independent researchers.

Instructor

Eddy has worked at BlackRock, Thomson Reuters, and Morgan Stanley, and has an MS in Financial Engineering from HEC Lausanne. Eddy taught data analytics at UC Berkeley and contributed to Udacity's Self-Driving Car program.

Instructor

Brok has a background of over five years of software engineering experience from companies like Optimal Blue. Brok has built Udacity projects for the Self Driving Car, Deep Learning, and AI Nanodegree programs.

Instructor

Elizabeth received her PhD in Applied Physics from Stanford University, where she used optical and analytical techniques to study activity patterns of large ensembles of neurons. She formerly taught data science at The Data Incubator.

Curriculum Lead

Cindy is a quantitative analyst with experience working for financial institutions such as Bank of America Merrill Lynch, Morgan Stanley, and Ping An Securities. She has an MS in Computational Finance from Carnegie Mellon University.

Curriculum Lead

Cezanne is an expert in computer vision with a Masters in Electrical Engineering from Stanford University. As a former researcher in genomics and biomedical imaging, she's applied computer vision and deep learning to medical diagnostic applications.

Instructor

Arpan is a computer scientist with a PhD from North Carolina State University. He teaches at Georgia Tech (within the Masters in Computer Science program), and is a coauthor of the book Practical Graph Mining with R.

Instructor

Luis was formerly a Machine Learning Engineer at Google. He holds a PhD in mathematics from the University of Michigan, and a Postdoctoral Fellowship at the University of Quebec at Montreal.

Content Developer

Juan is a computational physicist with a Masters in Astronomy. He is finishing his PhD in Biophysics. He previously worked at NASA developing space instruments and writing software to analyze large amounts of scientific data using machine learning techniques.

Average Rating: 4.6 Stars

496 Reviews

Combine technology training for employees with industry experts, mentors, and projects, for critical thinking that pushes innovation. Our proven upskilling system goes after success—relentlessly.

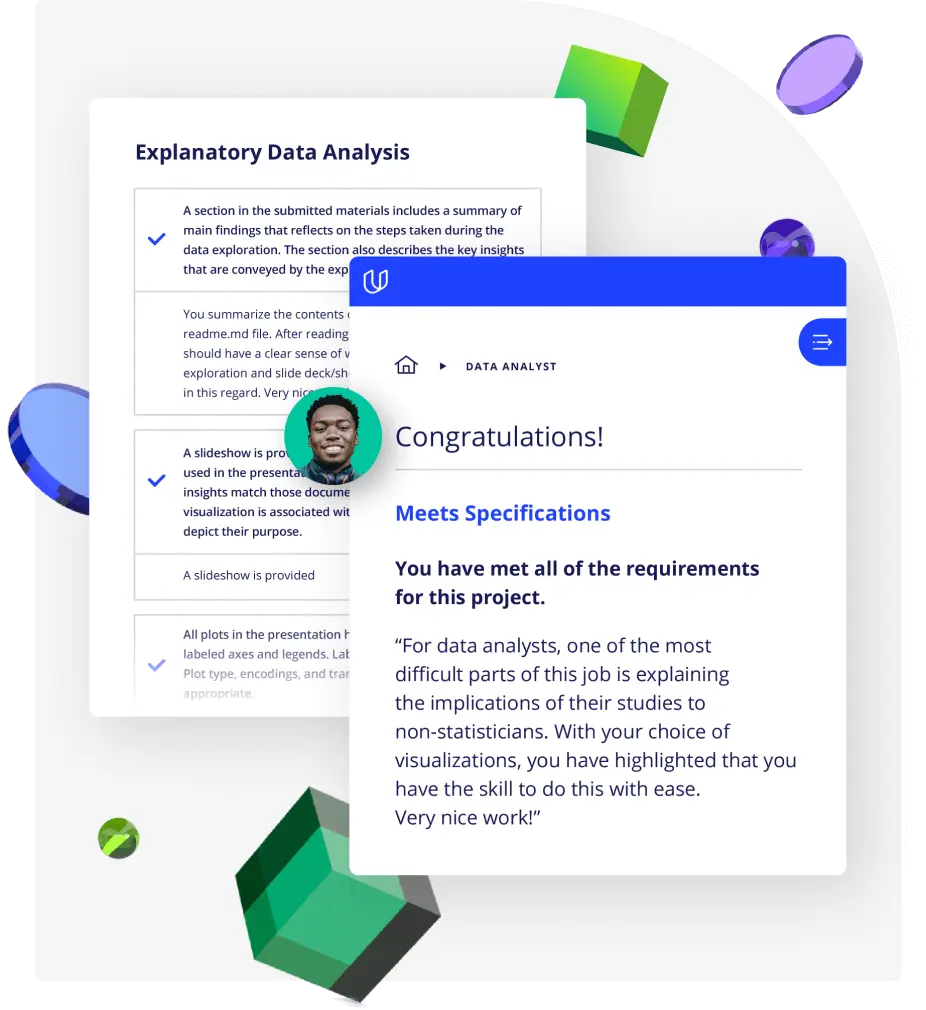

Demonstrate proficiency with practical projects

Projects are based on real-world scenarios and challenges, allowing you to apply the skills you learn to practical situations, while giving you real hands-on experience.

Gain proven experience

Retain knowledge longer

Apply new skills immediately

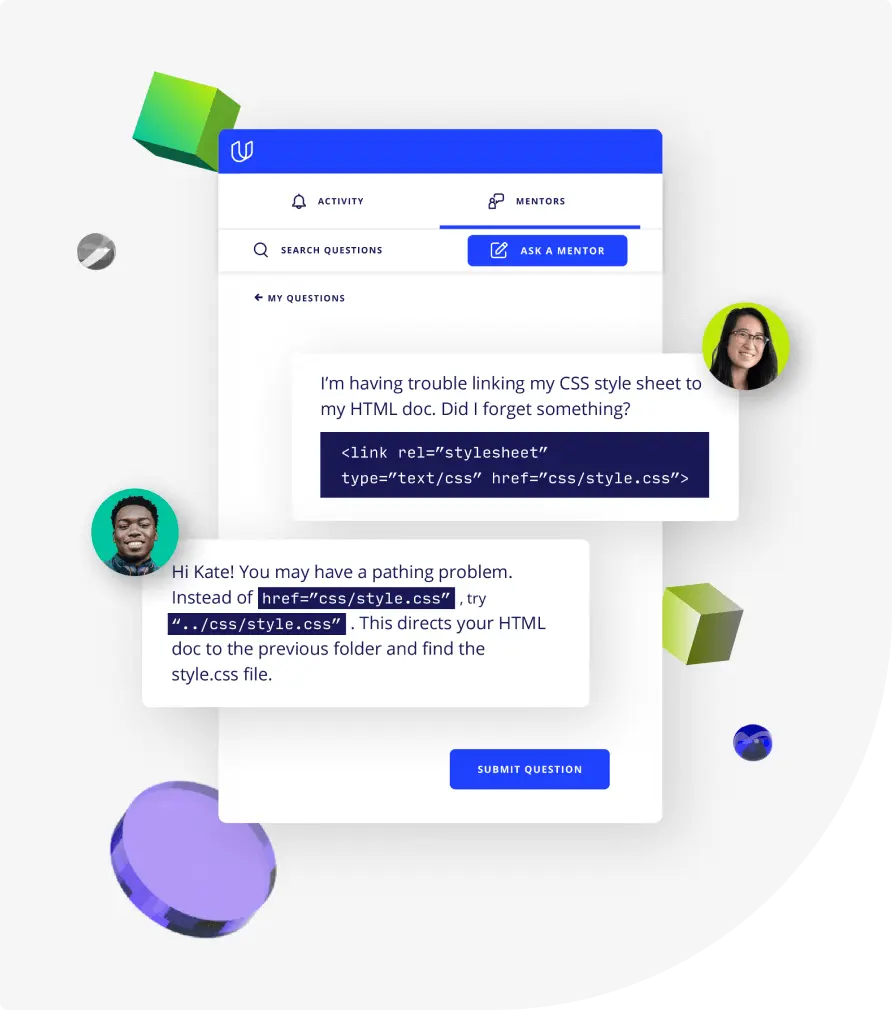

Top-tier services to ensure learner success

Reviewers provide timely and constructive feedback on your project submissions, highlighting areas of improvement and offering practical tips to enhance your work.

Get help from subject matter experts

Learn industry best practices

Gain valuable insights and improve your skills

Unlimited access to our top-rated courses

Real-world projects

Personalized project reviews

Program certificates

Proven career outcomes

Full Catalog Access

One subscription opens up this course and our entire catalog of projects and skills.

Average time to complete a Nanodegree program

AI for Trading